The crypto market has lost over $325 billion since Friday, with almost half of that wiped out in the last 24 hours.

According to The Kobeissi Letter, the crypto market cap has shed over $325 billion since Friday. Within the last 24 hours alone, approximately $150 billion has been liquidated, with $100 billion erased in just one hour today. The sell-off has affected nearly all crypto assets, including memecoins.

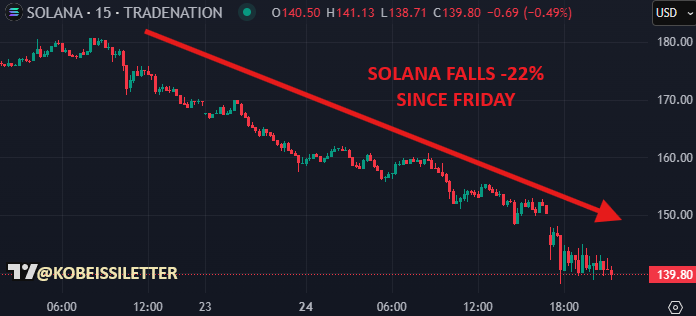

Analysts at The Kobeissi Letter trace the beginning of the downturn to Solana (SOL), which has crashed 22% since Friday as the memecoin frenzy cooled off.

Then, Bitcoin (BTC) followed suit, losing its relative strength, as the S&P 500 began to pull back on Friday. Earlier today, Bitcoin broke below the $90,000 support level, further reinforcing the bearish sentiment.

Market sentiment has also been hit by the Bybit hack, which has now been confirmed as the second-largest hack in crypto history. On Feb. 21, Bybit lost over 400,000 ETH from its cold wallet. As a result, Ethereum (ETH), which had already been showing weak momentum before the hack, weakened even further. According to Coinmarketcap, ETH opened at $2,740 on Feb. 21 and dropped to a low of $2,408 at the time of writing, marking almost 12% decline.

Furthermore, Citadel Securities‘ $65 billion pivot toward crypto liquidity was strangely met with a “sell the news” reaction in the market.

“Despite all of this, The Kobeissi Letter analysts remain optimistic. “We have seen countless -10% pullbacks in Bitcoin over the course of this bull run. Technical pullbacks are healtthy. However, since crypto markets thrive on liquidity, a sustained reduction in risk appetite could keep pressure on prices, the analysts added.

On the bright side, Bybit CEO Ben Zhou announced that the exchange had covered the losses as of Feb. 24 and published a proof-of-reserves audit to reassure the community. Analysts at Bitfinex suggested that Bybit’s replenishment of customer funds could lead to significant Ethereum purchases, which might counteract some of the selling pressure and drive ETH prices higher. They explained that acquiring ETH through the open market and other channels could have a stabilizing effect on its price.

That being said, Bitfinex analysts emphasized that uncertainty remains high as the broader market remains in a correction phase. Bitcoin, Ethereum, and Solana have all declined in Feb. after their late 2024 rallies. Meme coins, which surged in Dec., have also dropped by 37.4%. Finally, monthly crypto open interest has decreased as traders unwind leveraged positions in response to weaker momentum and increasing uncertainty.

According to Bitfinex, the next significant movement for Bitcoin and the broader market will depend on the broader macroeconomic factors.