Zora extended its rally for the second day in a row following the launch of its new content monetization tool, Creator Coins, on Base.

According to crypto.news, Zora (ZORA) surged to a 3-month high of $0.022 on Sunday, July 20, before slightly easing to $0.021 at the time of writing, still up 80% over the past 24 hours. At its current price, ZORA is now trading nearly 200% above its monthly low.

The rally appears closely tied to Zora’s integration with Base App, Coinbase’s newly rebranded Layer-2 wallet. The app now allows users to tokenize and trade content directly through their social profiles, powered by both Zora’s and Farcaster’s infrastructure.

In this setup, Zora provides the backend tech that enables content tokenization. Its token, ZORA, is used for minting content coins, paying referral fees, and engaging with ecosystem rewards, positioning it as a core part of Base’s social-token layer.

Data from Dune shows that daily coin creation via Zora has doubled since the Base App integration, jumping from under 5,000 to over 10,000 tokens minted per day.

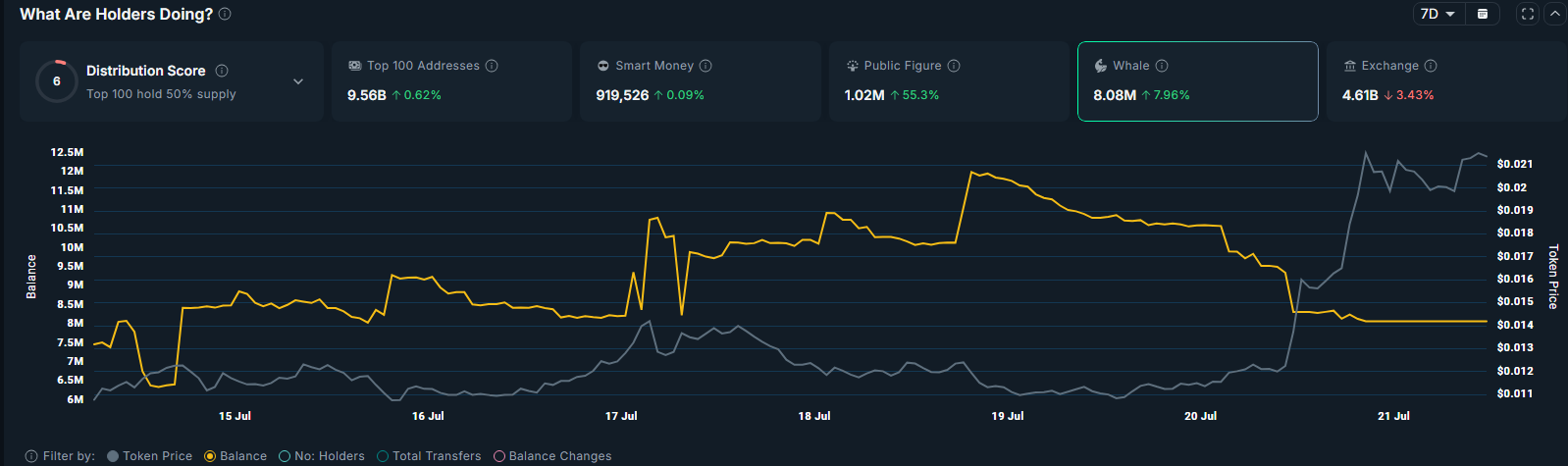

Meanwhile, on-chain data from Nansen shows whale wallets have increased their ZORA holdings by 7.9% over the past week to 8.08 million tokens. Public figures have also boosted their holdings by 55.3%, pushing their collective exposure to over 1 million tokens.

At the same time, ZORA supply on exchanges have also dipped 3.4% over the past week, now sitting at 4.61 billion tokens. That’s a noticeable drop from the 6.05 billion held on exchanges back in April.

Together, these accumulation trends confirm that investor demand for the token remains high, which can help support the rally even further.

ZORA price analysis

On the daily chart, ZORA printed a ‘god candle’ yesterday, followed by another green candle today, signaling sustained upward momentum.

The token has successfully broken above a key resistance level at $0.015, which also aligns with the 38.2% Fibonacci retracement level, a zone where bears had previously exerted strong selling pressure.

Technical indicators further support the bullish outlook. The 20-day simple moving average has crossed above the 50-day, forming a golden cross, a classic signal of a trend reversal to the upside. Momentum indicators, including the MACD and RSI, are also trending upward, reflecting growing buying pressure.

If bullish momentum continues, ZORA could extend its rally toward the all-time high of $0.034. A decisive breakout above that level would push the token into price discovery, opening the door for further gains.

However, with RSI levels approaching overbought territory, a short-term pullback remains a possibility before the uptrend resumes.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.