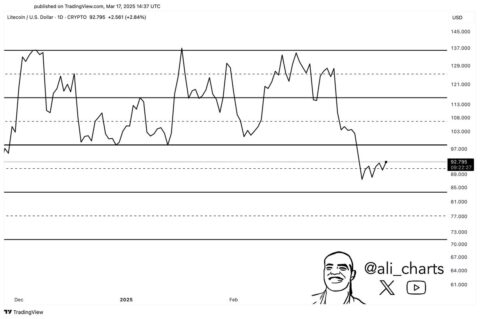

U.S. shares erased their positive aspects from earlier within the buying and selling day, as merchants grew to become more and more cautious forward of commerce talks between the U.S. and China.

Regardless of some constructive information on the commerce entrance, traders stay skeptical. On Friday, Could 9, main U.S. inventory indices had been down throughout the board. The Dow Jones misplaced practically 200 factors or 0.48%, the S&P 500 fell 0.24%, whereas the tech-focused Nasdaq declined 0.19%.

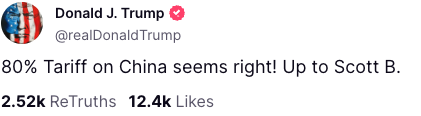

The markets are eagerly awaiting developments in commerce talks between the U.S. and China. U.S. President Donald Trump signaled that he was ready to decrease tariffs on all Chinese language items to 80%. He added that the choice would in the end be as much as Treasury Secretary Scott Bessent.

Whereas this charge stays prohibitively excessive for a lot of exporters, it’s decrease than the earlier 145% imposed earlier. Extra importantly, Trump’s rhetoric suggests a tone of de-escalation forward of the essential commerce negotiations with China. The talks may assist scale back reciprocal tariffs between the 2 nations, as China had retaliated with its personal 125% tariff on U.S. items.

Technique, Palantir, among the many greatest losers, gold positive aspects

Amongst tech shares, Palantir was among the many worst performers, down 2.23% as we speak. The inventory is ready to shut the week down 5% as traders reassess its excessive valuation. Notably, on Tuesday, its shares dropped 12%, dropping 35 million in market cap on account of a drop in quarterly earnings.

Curiously, shares of Technique, a leveraged Bitcoin funding agency, had been additionally down 1.78% since market open. That is regardless of Bitcoin (BTC) posting a 1.23% improve during the last 24 hours and a 5% improve over seven days.

Then again, bearish sentiment within the inventory market prompted many merchants to extend their gold publicity. The dear metallic was up 1.16%, reaching $3,344 per ounce.