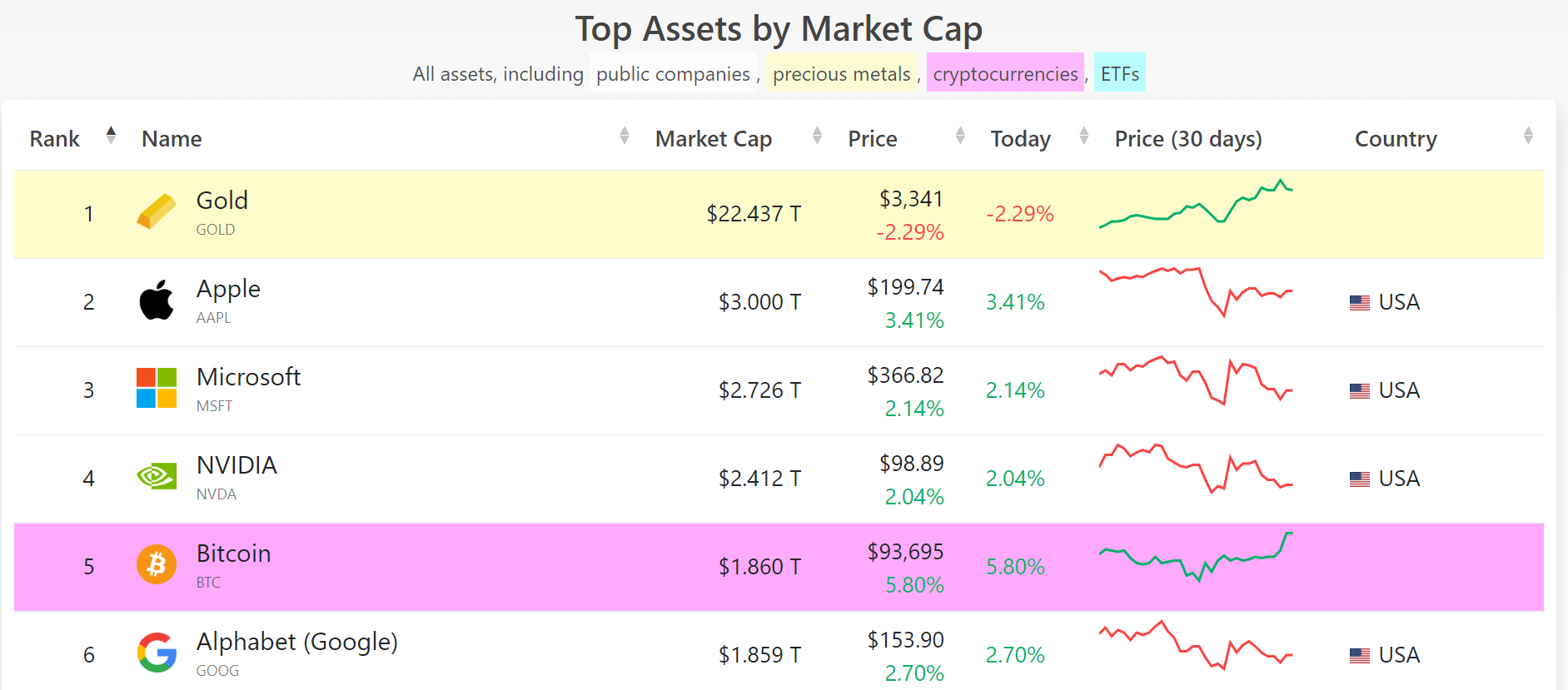

Bitcoin overtakes Google and Amazon by market cap, claiming its place as the fifth largest asset. This milestone comes only a day after BTC surpassed $94,000.

On April 23 at around 11:20 AM UTC, Bitcoin (BTC)’s market cap surged to $1.86 trillion following its price increase to $94,320. The rise in BTC’s market cap surpassed that of industry strongholds like Google and Amazon.

Google’s market cap currently stands at $1.859 trillion, meanwhile Amazon has a market cap of $1.837 trillion. Not only that, BTC also managed to beat silver, another safe-haven asset, on the leaderboard. Silver currently has a market cap of $1.853 trillion.

However, Bitcoin still has a long way to go before it can overtake the other corporate giants on the list. At number four is software company NVIDIA with $2.41 trillion in market cap, while Microsoft occupies the third spot with $2.72 trillion.

Apple sits at second place with a market cap of $3 trillion. Gold still has a strong grip on the top spot as the largest asset by market cap with $22.4 trillion.

At press time, BTC remains the only cryptocurrency within the top 10 largest assets by market cap. Ethereum (ETH) lags far behind in 61st place with $217.5 billion in market cap.

According to data from crypto.news, Bitcoin has gone up by 5.8% in the past 24 hours of trading. BTC is currently trading hands at $93,701. However, it briefly reached a peak of $94,320 which led to a surge in market cap by more than 6%.

Cathie Wood believes Bitcoin’s market cap can overtake gold

Last December, founder and CEO of ARK Investment Management, Cathie Wood predicted that BTC will one day become “bigger” than gold. At the time, BTC recently hit $2 trillion in market cap, while gold stood at $15 trillion.

Wood believed BTC is still in its early stages, therefore it won’t take long before the largest cryptocurrency by market cap surpasses gold and becomes the largest asset overall.

Historically, gold and Bitcoin share many similarities. Both are safe haven assets used as a hedge against inflation and the broader economic uncertainty of traditional markets. Both assets also have a finite supply that needs to be mined. Moreover, gold is often used as an indicator for BTC, as macro Bitcoin trends tend to follow gold’s movements after a few months.

Recently, gold reached a new all-time high of $3,900 as investors brace for more economic uncertainty amid rising global trade tensions and a weakening dollar. Around the same time, BTC reached a new monthly high of $87,570. Not long after, BTC managed to surpass $94,000.