Aerodrome Finance’s token continued its sturdy bullish momentum on Thursday, June 19, as community exercise and market share surged.

Aerodrome Finance (AERO) value rose to a excessive of $0.9660, its highest swing since February 4, and 235% above its lowest level in April. This surge has introduced its absolutely diluted valuation to over $1.54 billion.

AERO’s breakout coincided with rising market share within the decentralized alternate sector. DeFi Llama data exhibits that Aerodrome is now the sixth-largest DEX by month-to-month quantity, trailing solely PancakeSwap, Uniswap, Raydium, Orca, and Pump. The protocol processed over $14.86 billion in buying and selling quantity over the previous 30 days.

On Base, the layer-2 community developed by Coinbase, Aerodrome continues to dominate. It dealt with over $525 million in transactions, outperforming Uniswap’s $349 million on the identical chain. This spike in exercise has translated into increased protocol income, with month-to-month charges rising to $19.7 million in Could, up from $13.2 million a month earlier. It has remodeled $10 million to this point this month.

Aerodrome’s progress trajectory could proceed, particularly following Coinbase’s announcement that it’s going to help prime DEX networks on Base inside its platform. This integration may introduce Aerodrome to thousands and thousands of latest customers throughout Coinbase’s cell and internet purposes.

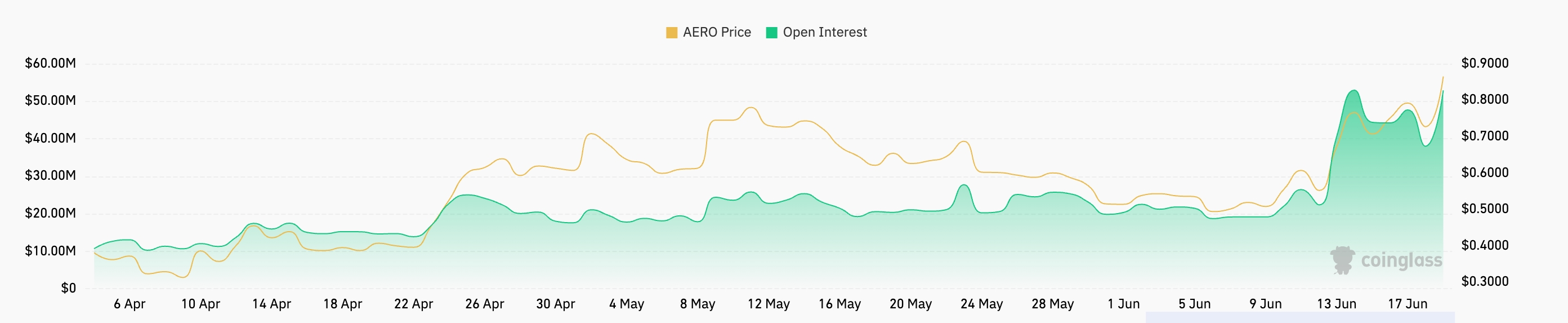

The AERO token additionally surged alongside a pointy rise in futures open curiosity, which climbed to a file $52.9 million, up from a month-to-month low of $19 million. Rising open curiosity sometimes alerts rising demand and deeper liquidity.

AERO value technical evaluation

The AERO token value surged to the best level since February as crypto.information predicted here. The value moved decisively above the $0.8010 resistance stage—coinciding with the 23.6% Fibonacci retracement, and in addition cleared the higher boundary of an ascending triangle sample, a widely known continuation sign.

AERO value has moved above the 50-day Exponential Shifting Common, whereas the Relative Power Index has pointed upwards and is nearing the overbought stage.

Given these situations, AERO is more likely to keep its uptrend, with bulls concentrating on the 50% Fibonacci retracement stage at $1.3170, about 41% above present ranges. A drop again under the triangle’s higher boundary would invalidate this bullish outlook.