Pi Network price has been flat in June and is not participating in the ongoing crypto bull run.

Pi coin (PI) token was trading at $0.63 on Tuesday, June 10, where it has remained since May 31. It has dropped by 62 percent from its highest point in March and is well below its all-time high of $3.

The 12-hour chart suggests a potential Pi coin price short squeeze as the token continues to consolidate. The spread between the three lines of the Bollinger Bands has narrowed, indicating that volatility has declined.

In most cases, a narrowing spread in these bands leads to a strong bullish breakout. A recent example, covered here, occurred in May when the token surged 175 percent to a high of $1.6660.

Similarly, the historical volatility indicator has plunged to 22.24, its lowest level since May 7. It has dropped sharply from last month’s high of 356.87. The Average True Range indicator, another key volatility measure, has fallen to 0.025, also its lowest level since May 6.

Pi Network has also formed a double-bottom pattern with support at $0.5850 and a neckline at $1.6708.

The double-bottom and falling volatility indicators both suggest the potential for further upside, with key targets at the psychological level of $1 and the neckline at $1.6708. These levels are approximately 57 percent and 160 percent above the current price.

A drop below support at $0.5497 would invalidate the bullish outlook and point to more downside, potentially toward the all-time low of $0.40.

Potential catalysts for Pi coin

The first potential catalyst for Pi Network price is the broader crypto market bull run, which has pushed most altcoins higher.

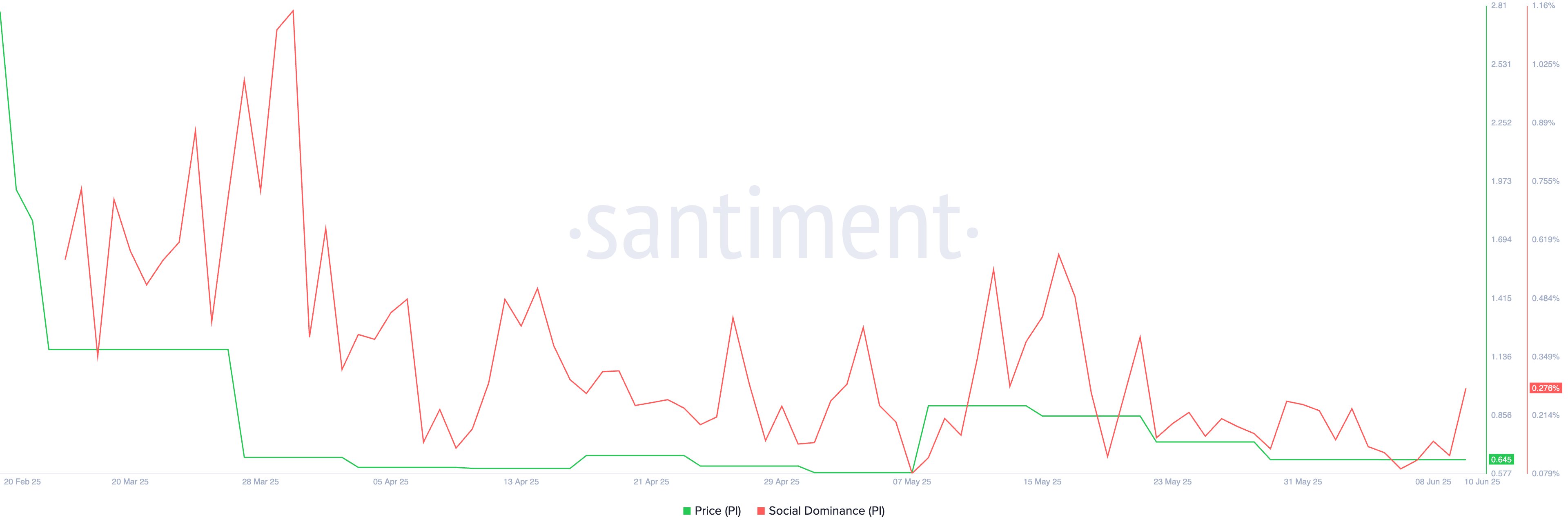

Additionally, there are signs that Pi’s social media activity is increasing. Santiment data shows social dominance rising to 0.276 percent, its highest level since May 21 and up from this month’s low of 0.09 percent.

Another possible catalyst is the upcoming Pi Day 2 event on June 28. This annual occasion is considered an alternative to the original Pi Day on March 14. It also marks the end of the .pi domain auction and the Open Network PiFest.

Finally, Pi Network may experience a short squeeze if one or more exchanges decide to list the token. For instance, Orca price jumped by 200% after the Upbit listing. Similarly, Axelar, Pocket Network, and Ravencoin prices surged after their Upbit listing.