AscendEx, beforehand generally known as Bitmax, is the worldwide crypto exchange platform, which helps over 100 cryptocurrencies, together with BTC, ETH, LTC, DOGE, and so on. This text will concentrate on staking providers — AscendEx Staking (Bitmax Staking), Defi Yield Farming, and different options like Curve (Polygon) Yield Farming.

Abstract (TL;DR)

- Staking is a solution to earn digital asset mining rewards with out investing in costly {hardware} having excessive processing energy.

- AscendEx Staking helps immediate unbounding, which permits customers to un-stake property to put orders or withdraw instantly.

- AscendEx affords round 50 staking tasks like DOT (Polkadot), ASD (AscendEx Native Token), ATOM (Cosmos), CUDOS (Cudos), BOND (Bonded Finance), SWINGBY (Swingby), and so on.

- For every staking undertaking, there can be a minimal delegation quantity worth. Subsequently, your staked quantity must be higher than or equal to the minimal delegation quantity.

- DOT-S signifies staked DOT tokens.

- AscendEx staking helps two sorts of undelegation: Common undelegation and immediate unbounding.

- DeFi Yield Farming permits customers to earn both mounted or variable curiosity by investing digital property in a DeFi protocol.

- Staking goals to assist blockchain networks keep safe and yield farming’s focus to realize the best doable yield.

- In DeFi yield farming, secure cash like USDT, USDC, Dai, and Tether are most well-liked.

- Curve (Polygon) Yield Farming is newly launched by AscendEx this week (2nd week of July 2020).

AscendEx Staking

Staking is a solution to earn digital asset mining rewards with out investing in costly {hardware} with excessive processing energy. This can be a very handy solution to earn passive earnings by holding digital property on the AscendEx exchange.

If you stake eligible tokens, you lock your tokens into your chosen Proof of Stake (PoS) blockchain. Staked tokens are used to realize consensus, which is necessary to maintain the community safe whereas validating each new transaction on the blockchain.

As rewards, customers will obtain new tokens from the community. These rewards can be proportional to the variety of tokens staked; the upper the variety of tokens staked, the higher the validation energy.

If we discuss a conventional staking mechanism, you lock your staked property for a selected time period if you go for staking. Through the unbounding interval, neither do you may have entry to your staked property nor you eligible to obtain staking rewards. Due to this, you may’t place orders to promote staked property. Additionally, you may’t even withdraw or switch your property to a different change or pockets.

Whereas AscendEx Staking has an idea of immediate unbounding, customers can un-stake property to put orders or withdraw instantly. Moreover, AscendEX permits staked property for use as margin collateral. This solely applies to the property that are supported by the platform for margin buying and selling.

Additionally, learn Staking Crypto – An Ultimate Guide on Crypto Staking [2021]

Steps to start with AscendEx Staking

Utilizing Desktop

Earlier than you proceed to take part in AscendEx Staking, first log in to your AscendEx account. In case you don’t have an account, please create an account on AscendEx after which log in.

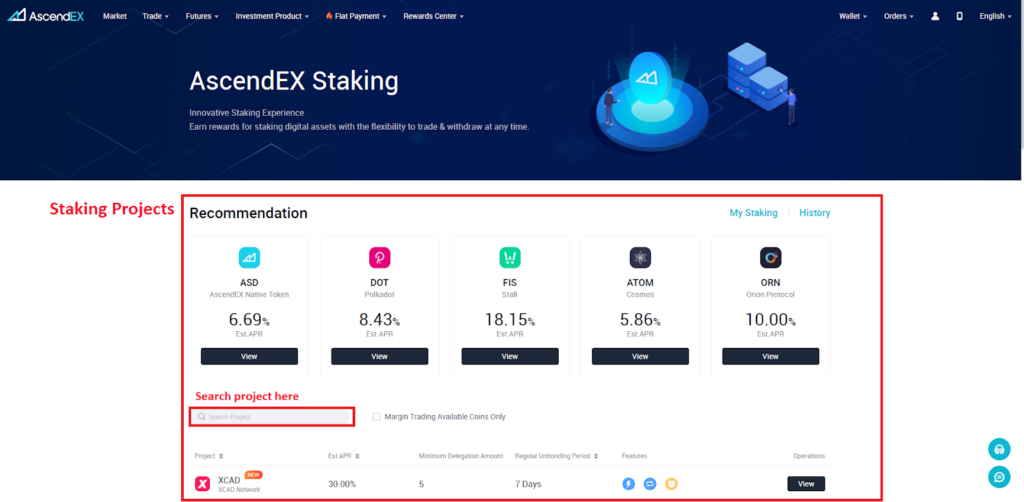

- Head over to AscendEx Staking web page.

- AscendEx affords round 50 staking tasks like DOT (Polkadot), ASD (AscendEx Native Token), BOND (Bonded Finance), and so on.

- Open any undertaking. For instance, right here, I’m opening the DOT staking undertaking by clicking on it.

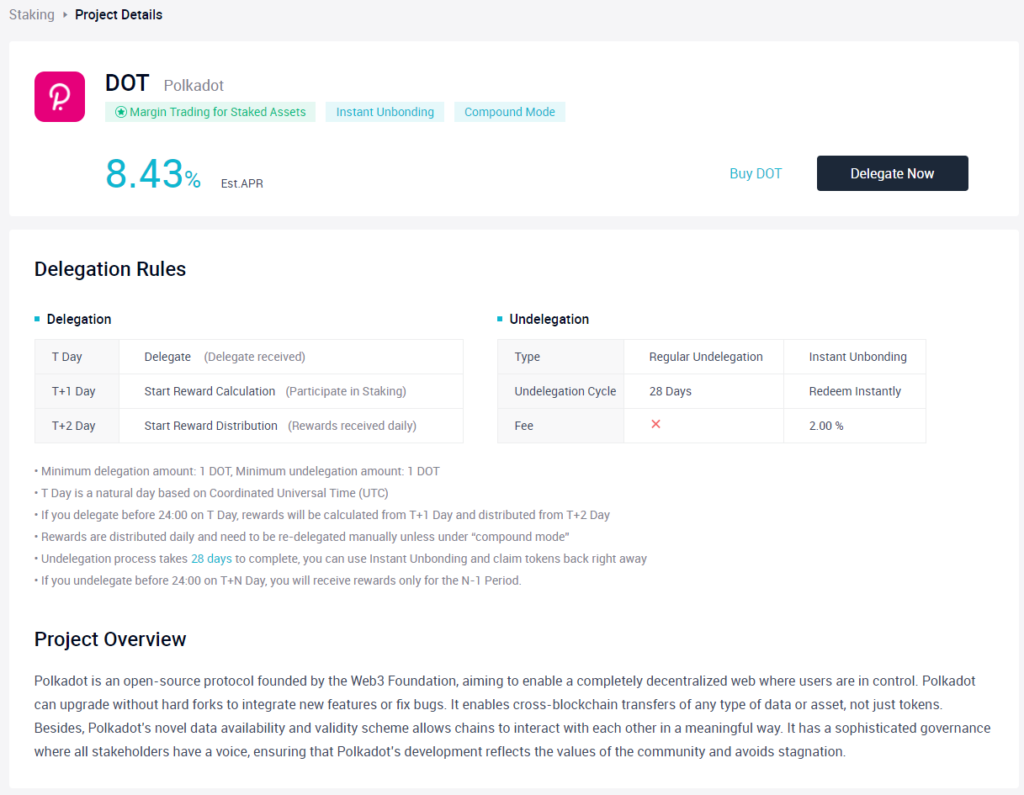

- On the DOT staking web page, you’ll find undertaking overview and delegation guidelines for chosen staking undertaking. There can be two buttons to proceed additional, Purchase DOT and Delegate Now. Click on on the “Delegate Now” button to stake DOT tokens. In case you don’t have DOT tokens in your pockets, go for the “Purchase DOT” choice.

- It should take you to the DOT/ USDT buying and selling web page, the place you should buy DOT tokens by putting an order.

- After getting ample funds, click on on Delegate Now.

- This can open a pop-up window to arrange DOT Delegation.

Utilizing Cellular App

- Open AscendEx App.

- In case you don’t have AscendEx App, please obtain for Andriod from here and iOS from here. (Use this referral code B7N5N8TRJ, to get a reduction on the charges)

- Click on on “Staking”.

- On the “All Staking” web page, you’ll find the listing of staking tasks provided by AscendEx. Seek for any undertaking and choose considered one of your decisions.

- It should take you to the chosen undertaking’s staking web page. In case you don’t have sufficient chosen property to delegate, go to the DOT/ USDT pair to purchase some, after which observe steps 1, 2, and three once more.

![A Guide to AscendEx Staking 3 AscendEx Staking [Mobile App]](https://coincodecap.com/wp-content/uploads/2021/07/image-126-1024x428.jpg)

![A Guide to AscendEx Staking 3 AscendEx Staking [Mobile App]](https://coincodecap.com/wp-content/uploads/2021/07/image-126-1024x428.jpg)

Shifting forward with Delegation

- Allow “Compound Mode” to allow auto-redelegation of staking rewards and compound your return.

- Enter “Delegation Quantity”. For every undertaking, there can be a minimal delegation quantity worth. Ensure you enter a delegation quantity higher than or equal to the minimal required worth. In case you don’t have sufficient property to delegate, you may click on on the purchase choice, which we now have already mentioned.

- Learn AscendEx Staking Settlement and examine the field(I’ve learn and agreed to AscendEx Staking Settlement).

- Click on on “Delegate Now”.

- Yow will discover staking particulars underneath “My Staking”.

Steps to un-stake in AscendEx

AscendEx Staking: un-stake utilizing Desktop

- Open My Staking web page on AscendEx.

- You will discover an inventory of tasks during which you may have staked property. Click on on Undelegate to un-stake your property from a selected undertaking.

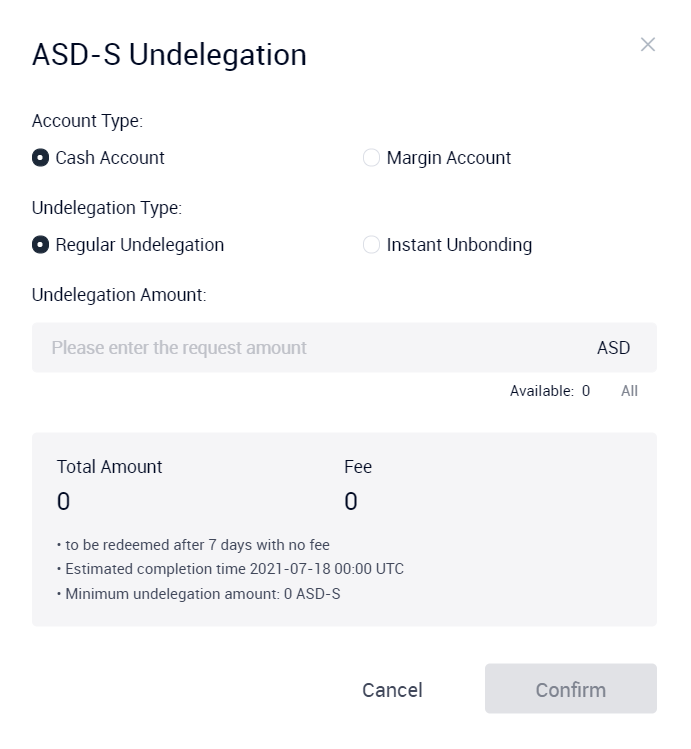

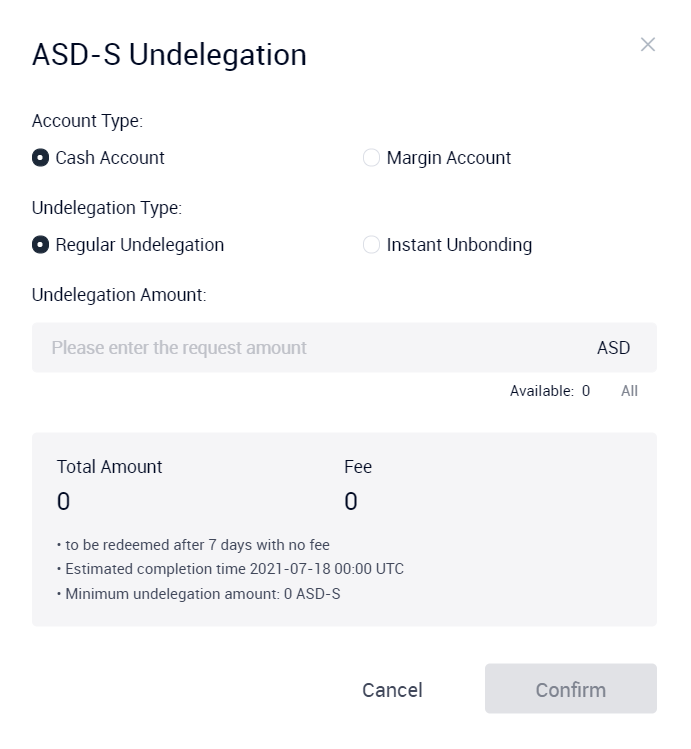

- It should open one pop-up window.

- Choose Account Kind: Money account or Margin account

- Choose Undelegation Kind: Common undelegation or Immediate Unbounding.

- In common delegation, property can be redeemed after seven days with no payment.

- In immediate unbounding, property can be redeemed immediately with 2.5% of the payment.

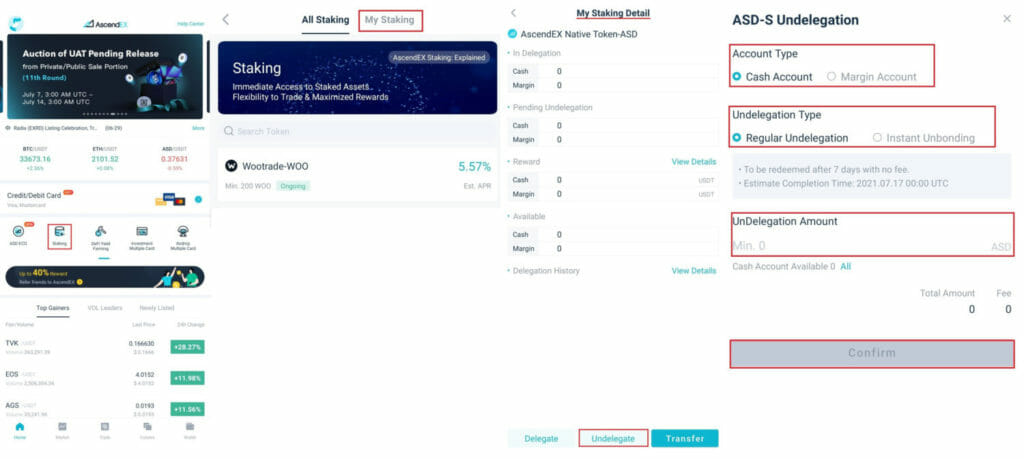

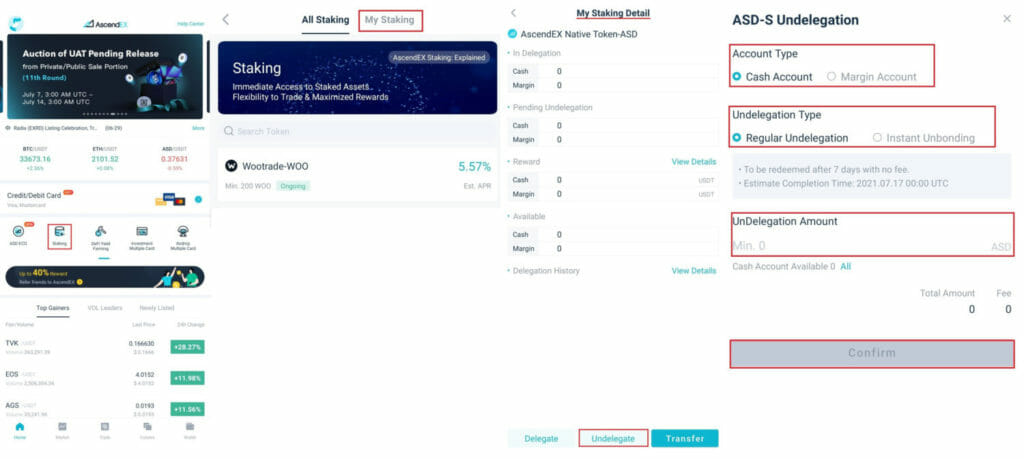

AscendEx Staking: un-stake utilizing Cellular App

- Open AscendEx App.

- Click on on “Staking”.

- Click on on “My Staking”.

- Choose a undertaking from which you wish to undelegate your tokens.

- Click on on the “Undelegate” button.

- It should open one pop-up known as “Project_Name – S Undelegation”.

- Click on on Affirm.

What’s Yield Farming?

Yield Farming permits customers to quickly lock up their holdings and earn rewards. It should allow customers to earn both mounted or variable curiosity by investing digital property in a DeFi protocol.

Yield Farming is much like Staking as, in each circumstances, you may earn passive earnings. Nonetheless, Subject Farming lends the locked-up digital property to DeFi protocols as a substitute of contributing to a proof of stake community. It locked up funds in a liquidity pool. The liquidity swimming pools energy {the marketplace} the place merchants can change, borrow, or lend tokens. When you’ve added your funds to a pool, you formally grow to be a liquidity supplier. DeFi lending protocols permit lenders to realize curiosity on their property whereas giving debtors entry to extra capital for buying and selling. In DeFi yield farming, secure cash like USDT, USDC, Dai, and Tether are most well-liked.

Additionally, learn DeFi Yield Farming and Liquidity Mining

AscendEx Staking: Advantages of Yield Farming

- “One-click” farming performance,

- No Fuel charges, and

- Capacity to rotate between completely different protocols to maximise yields.

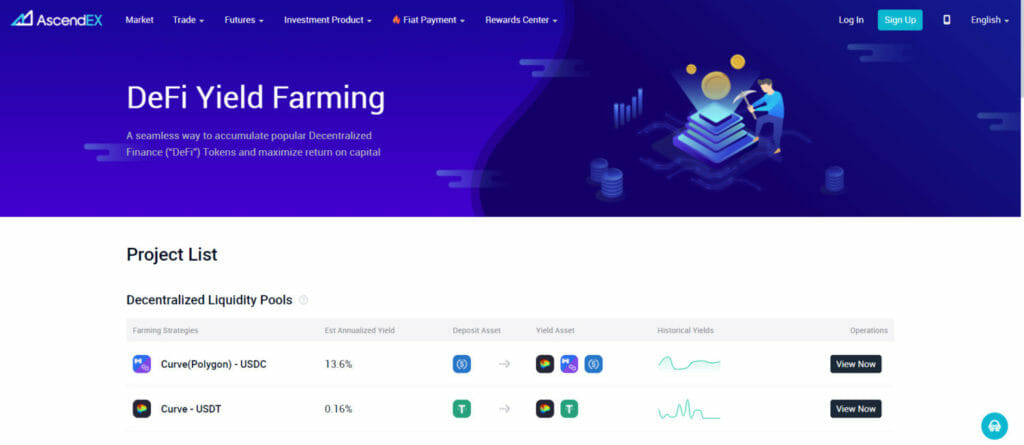

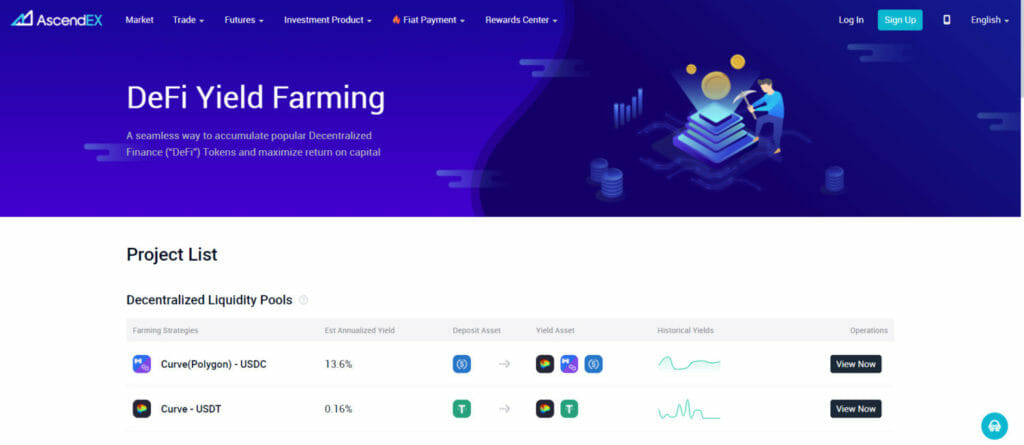

DeFi Yield Farming tasks on AscendEx

As of now, AscendEX affords Yield Farming merchandise like lending protocols and liquidity pooling. In liquidity pooling, you’ll act as a liquidity supplier by contributing property to swimming pools and earn transaction charges in return. In lending protocols, you require lending property to swimming pools in change for lending curiosity plus further token incentive issued.

There are 2 Decentralized Liquidity Swimming pools –

- Curve (Polygon) – USDC

- Curve – USDT

Additionally 1 Lending & Borrowing Challenge – HARC – USDX

Curve (Polygon) Yield Farming launched this week (2nd week of July 2020) on AscendEx. Therefore, we’ll talk about this undertaking in depth.

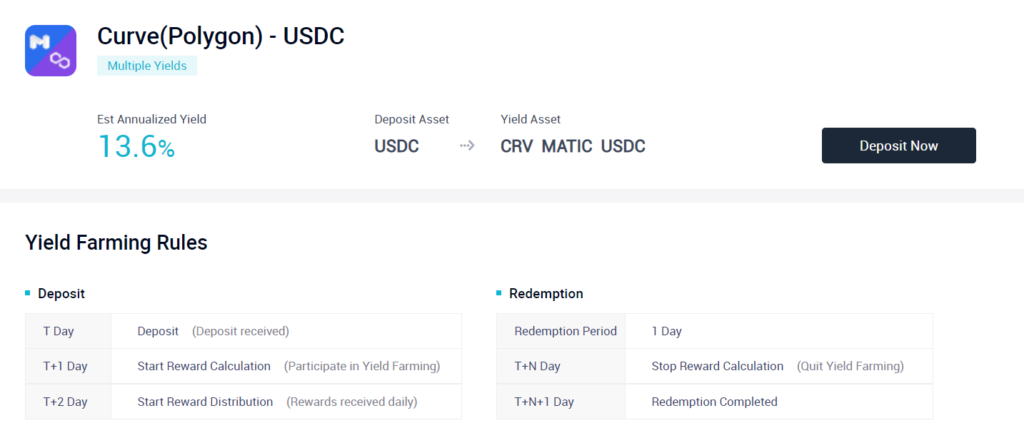

AscendEx Staking: Curve (Polygon) Yield Farming

Polygon is offering MATIC rewards to customers for being liquidity suppliers. As well as, Polygon is the primary well-structured, easy-to-use platform for ethereum scaling and infrastructure improvement.

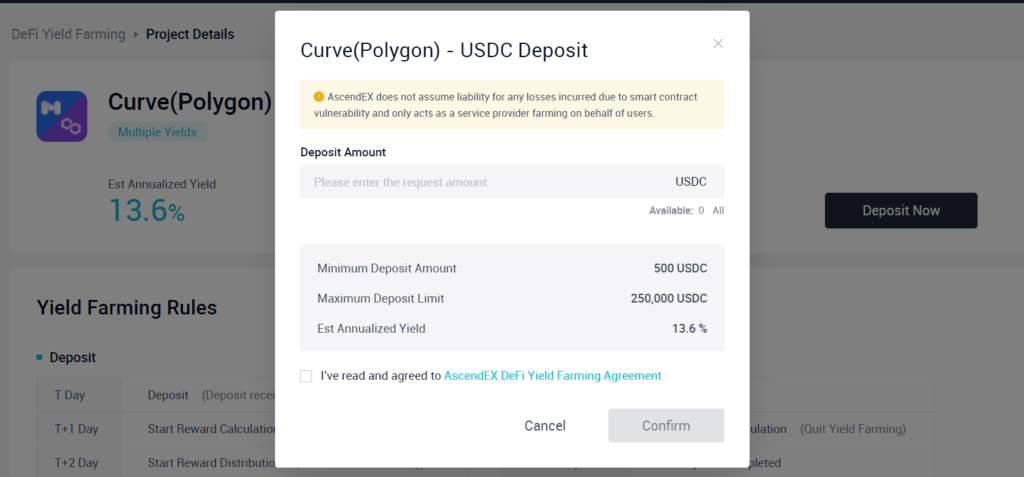

- Deposit asset: USDC (Minimal — 500 USDC, Most — 250,000 USDC)

- Yield asset: USDC + MATIC + CRV

- Minimal redemption quantity: 500 USDC

- T Day is a pure day based mostly on Coordinated Common Time (UTC). Subsequently, in the event you deposit earlier than 24:00 on T Day, rewards can be calculated from T+1 Day and distributed from T+2 Day.

- The redemption course of takes in the future to finish; Immediate Redemption Perform is at present unavailable.

Learn how to deposit in Curve (Polygon) Yield Farming?

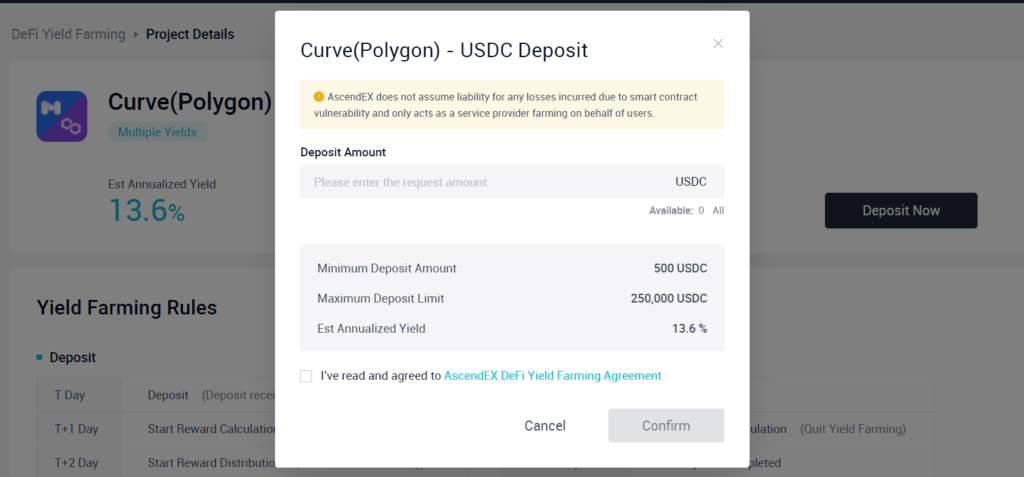

AscendEx Staking: Utilizing Desktop

- Open AscendEx’s DeFi Yield Farming web page.

- Click on on “View now” for Curve(Polygon) — USDC.

- This can open the Polygon Yield Farming web page.

- You will discover undertaking introduction and yield farming guidelines. Then, to take a position on this undertaking, click on on the “Deposit Now” button.

- Thereafter, enter “Deposit Quantity”. It must be higher than or equal to 500 USDC. As you may see within the pop-up window, the estimated annual yield is 13.6%.

- Learn AscendEx DeFi Yield Farming Settlement and examine the field.

- Lastly, click on on the “Affirm” button.

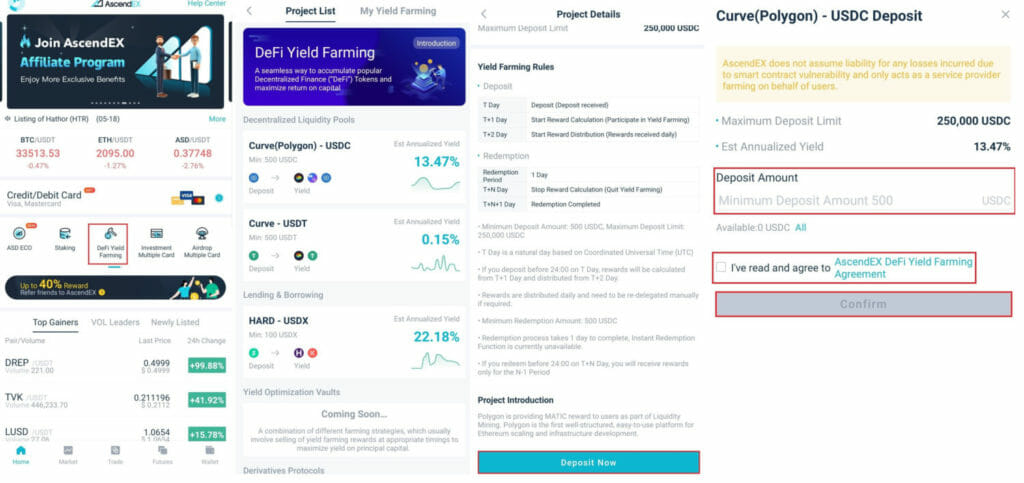

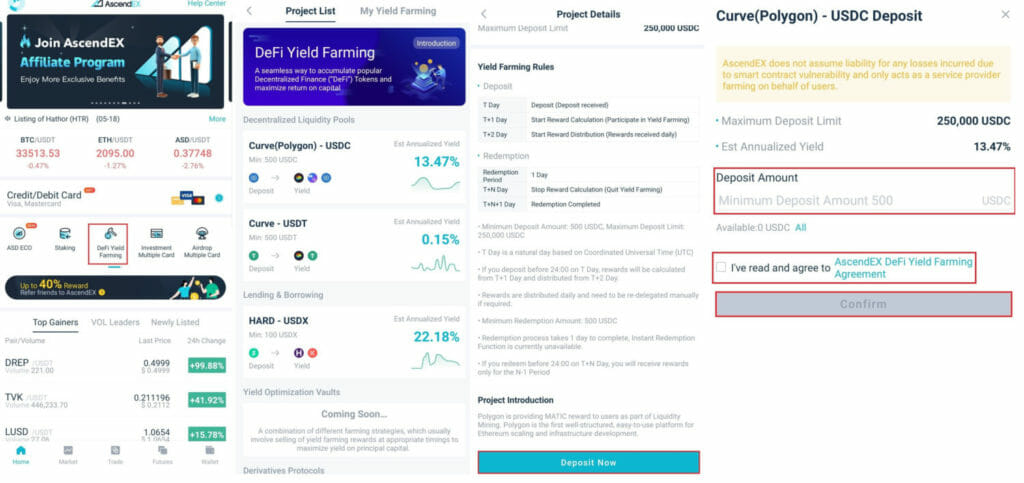

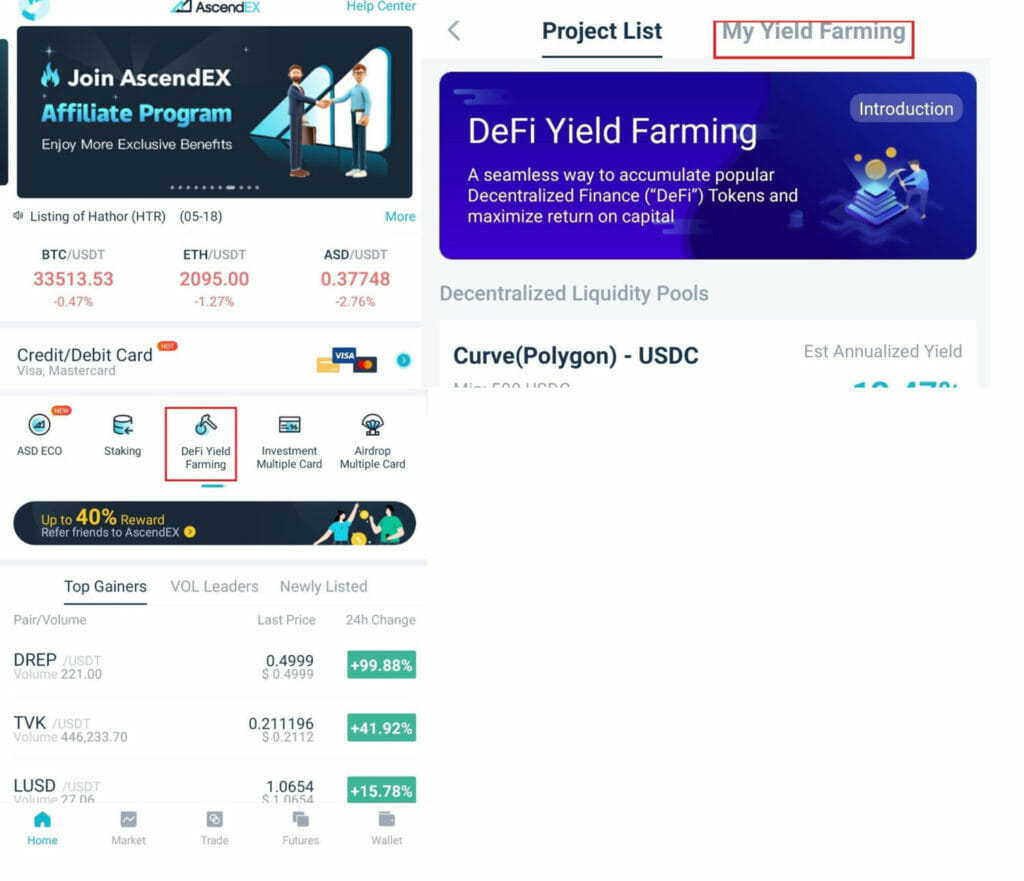

AscendEx Staking: Utilizing Cellular App

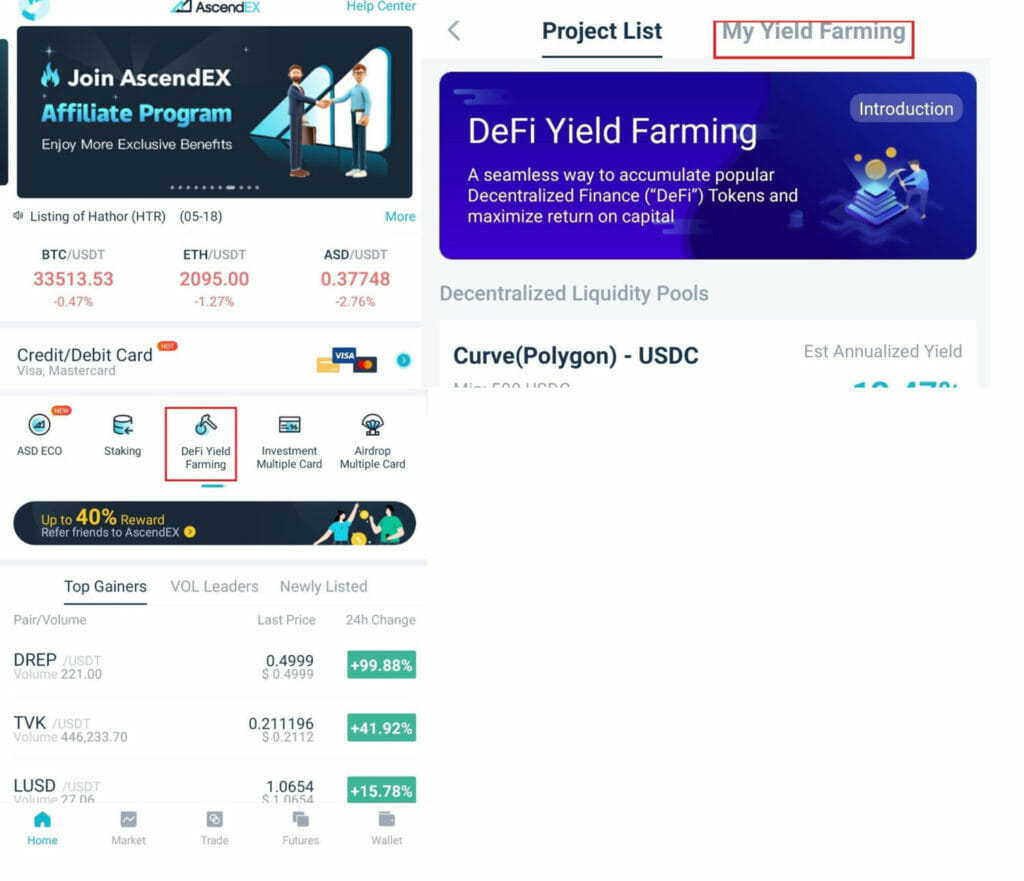

- Open AscendEx App.

- Click on on “DeFi Yield Farming”.

- On the “Challenge Record” web page, you’ll find the listing of yield farming tasks provided by AscendEx. For instance, choose “Curve (Polygon) – USDC”.

- This can take you to the “Curve (Polygon) – USDC” undertaking web page, the place you’ll find undertaking introduction and yield farming guidelines. Then, click on on “Deposit Now”.

- Thereafter, on the following web page enter “Deposit Quantity”.

- Click on on the “Affirm” button.

The place to see my yield farming?

On web site

- Go to AscendEx’s DeFi Yield Farming web page.

- Click on on “My Yield Farming”. This can lend you to the My Yield Farming web page.

On Cellular app

- Open AscendEx App.

- Click on on “DeFi Yield Farming”.

- Go to “My Yield Farming”. On the My Yield Farming web page, you’ll find all of your yield farming tasks’ funding particulars.

AscendEx Staking: Staking vs. Yield Farming

Staking and Yield Farming are comparable when it comes to rewards. However each have completely different functions. Staking goals to assist blockchain networks keep safe, and yield farming focuses on gaining the best doable yield.

Yield farming may be thought of essentially the most worthwhile choice to earn passive earnings, however it’s extremely dangerous. For instance, APY (Annual Share Yield) may be extremely affected by Ethereum’s gasoline charges. Therefore, if the market turns bearish or bullish out of the blue, the speed of revenue will drop.

In Yield farming, there may be additionally the chance that builders create a rip-off undertaking. For instance, after itemizing a brand new token and permits customers to deposit funds into liquidity swimming pools, the undertaking’s creator will shut the undertaking and disappear with funds.

Staking would possibly require you to lock your property (in some tasks) for a 12 months. Throughout this time, you may’t even withdraw or promote your staked property. And if the market turns to a bear market, you’ll endure extra loss than what you’ll achieve from staking.

AscendEx Staking: Conclusion

Staking and Yield Farming each permit customers to quickly lock up their holdings and earn rewards. Staking’s function is to assist blockchain networks to remain safe, and yield farming’s focus is to realize the best doable yield.

AscendEx supplies round 50 staking merchandise and three DeFi Yield Farming merchandise. However keep in mind, AscendEx doesn’t assure that you’ll obtain any particular rewards over time. It is determined by the undertaking proprietor or token community. So it’s your duty to discover a well-growing undertaking to spend money on.

Regularly Requested Questions

Does KYC verification require participation in staking?

Can I commerce my property whereas they’re staked?

Staked property can’t be traded instantly. As an alternative, they can be utilized as collateral for margin trading. If you wish to promote your staked property, you must unstake them first.

Can I unstake staked property anytime at AscendEx?

Sure, you may unstake your staked property anytime at AscendEx. To unstake your property, you may have two choices: Immediate unbounding and common undelegation. By selecting immediate unbounding, you may unstake them immediately, however it’ll cost 2.5% of the payment.

How are staking rewards calculated?

In most eventualities, in the event you stake your property on T day, Staking rewards can be calculated from T+1 day and can begin to distribute on T+2 day. Nonetheless, suppose you cease staking or undelegate between 0:00 to 24:00 on T+M day. In that case, your whole staking interval can be M-1 days, and you’ll obtain rewards just for M-1 days.

How does compound mode work?

Compound mode is a function that routinely restake or redelegates a consumer’s staging rewards every time when a consumer receives any.

Do estimated rewards the identical as precise rewards?

Precise rewards rely upon the undertaking’s community circumstances. Any adjustments in community circumstances can have an effect on precise rewards.

What’s the distinction between “DOT” and “DOT-S”?

A ticker ending with “-S” represents a staked steadiness. So, for instance, DOT-S means staked DOT as a result of we now have staked or delegated DOT tokens. And you may’t instantly commerce or withdraw staked tokens.