Because the market recalibrates post-halving and post-tariff, which crypto might increase in 2025 as volatility, liquidity, and adoption collide?

Which crypto might increase in 2025?

The 12 months 2025 is starting to mirror a shift away from short-lived pleasure and towards deeper modifications which can be steadily influencing how crypto finds its place throughout the broader monetary system.

After the sharp rise in 2024, which noticed the market cap cross $3 trillion, consideration is now turning as to whether that momentum is sustainable and what deeper forces are quietly steering the path.

Some of the consequential developments is the coverage recalibration underway within the U.S. With Donald Trump again in workplace, there’s renewed political curiosity in dismantling regulatory limitations that beforehand restricted the scope of digital belongings.

The rollback of SEC pointers akin to SAB 121 is one such instance, signaling that regulated monetary establishments could quickly be allowed to increase into crypto custody, settlement, and associated infrastructure.

That shift carries weight as a result of institutional participation is now not hypothetical. As of Could 9, Bitcoin (BTC) spot ETFs have attracted greater than $41 billion in inflows, confirming that enormous allocators are now not treating Bitcoin as a fringe allocation.

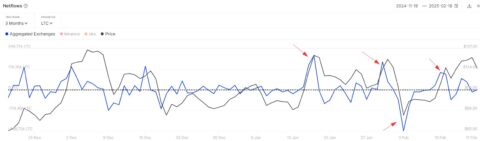

Nonetheless, the market doesn’t function in isolation. The reintroduction of U.S. tariffs in early 2025 triggered temporary pullbacks throughout threat belongings, together with crypto.

Nevertheless, the next rebound in the previous couple of days has revived bullish sentiment, notably amongst institutional buyers who proceed so as to add publicity in anticipation of regulatory readability.

Towards this backdrop of evolving regulation, let’s attempt to establish which crypto might increase in 2025, and why.

The core pillars — Bitcoin and Ethereum

Bitcoin and Ethereum (ETH) proceed to function foundational belongings within the crypto market, not merely due to their historical past however as a result of their roles have advanced alongside institutional habits, technical developments, and broader financial realignments.

Bitcoin’s latest efficiency has strengthened its positioning as a strategic reserve asset. After crossing $109,000 in January 2025, its momentum slowed, and the worth fell by practically 30% by early April.

As of now, BTC has regained floor and is buying and selling close to $103,000. A significant factor behind this restoration is the size and composition of inflows channeled by spot ETFs.

Worth projections fluctuate considerably. Speculative posts on X usually level to targets of $500,000 and even $1 million, though extra grounded fashions place Bitcoin throughout the $80,000 to $200,000 vary.

Experiences from Galaxy Digital have echoed this sentiment, forecasting ranges round $185,000 on account of institutional demand, declining issuance, and heightened curiosity in non-sovereign reserve belongings.

Ethereum, alternatively, operates as a crucial infrastructure layer throughout the broader crypto financial system. ETH is presently buying and selling round $2,330, having gained practically 28% prior to now 7 days.

The community’s transition to proof-of-stake in 2022 led to a discount in power consumption by over 99%, and the most recent Pectra upgrade introduces enhancements geared toward usability and scalability.

Key enhancements embrace doubling blob capability on layer 2 networks to ease congestion and decrease charges, enabling Account Abstraction to permit gasoline funds in tokens akin to Dai (DAI) or USD Coin (USDC), and elevating the utmost validator stake from 32 ETH to 2,048 ETH, which simplifies operations for big institutional validators.

These updates are designed to enhance accessibility, scale back the price of community participation, and accommodate rising throughput demand throughout layer 2 purposes.

Ethereum’s worth forecasts are additionally broadly debated, although typically extra tempered than these for Bitcoin. VanEck projects ranges above $6,000.

Institutional sentiment has grow to be extra cautiously optimistic for the reason that approval of spot Ethereum ETFs in July 2024, though capital flows into ETH merchandise stay under these seen within the Bitcoin market.

Bitcoin and Ethereum will not be positioned as high-upside bets like smaller altcoins, however their significance to each infrastructure and the broader crypto narrative continues to anchor their relevance throughout cycles.

Excessive-potential altcoins — Solana and Sui

Solana (SOL) continues to ascertain itself as one of the crucial functionally lively blockchains in 2025, supported by sturdy developer participation and constant traction, notably throughout the memecoin ecosystem.

Within the first quarter of 2025, Solana captured practically 40% of on-chain spot decentralized change buying and selling. Its benefit in execution velocity and affordability has made it a most popular surroundings for high-frequency, retail-driven exercise.

A lot of the amount has stemmed from speculative purposes. Pump.enjoyable, a platform that facilitates fast token creation and buying and selling, generated $400 million in income in 2024, even after token launch exercise dropped following the LIBRA incident.

Alongside memecoins, NFT and gaming tasks proceed to favor Solana on account of its low transaction prices and sub-second finality. Builders usually cite these traits as core causes for choosing Solana over Ethereum or different base layers.

Institutional curiosity has grown in parallel, with strategic partnerships and ecosystem funding reinforcing the chain’s credibility.

Worth forecasts for SOL stay wide-ranging. Analysts have steered targets between $220 and $520, whereas community-driven estimates usually cluster close to the $300 mark.

In the meantime, Sui (SUI), a more moderen Layer 1 developed by former Meta engineers at Mysten Labs, has additionally emerged as a contender for investor consideration.

Constructed utilizing the Transfer programming language and centered round an object-based execution mannequin, Sui helps parallel transaction processing. Underneath take a look at situations, it has achieved throughput nearing 297,000 transactions per second with sub-second finality.

In 2025, Sui’s worth action mirrored each momentum and volatility. After hitting an all-time excessive of $5.35 in January, it has corrected to $4.02 as of Could 9. With a market cap exceeding $13 billion, it now ranks among the many high fifteen crypto belongings by worth.

CoinCodex forecasts place Sui’s year-end worth between $6.86 and $8.53, contingent on market situations and sentiment-driven flows.

Nevertheless, buyers are watching intently as a $320 million token unlock scheduled for Could might inject short-term provide stress into the market.

For these exploring layer 1 chains past Bitcoin and Ethereum, each Solana and Sui supply data-backed narratives supported by technical traction and ecosystem development.

Nonetheless, as with all rising belongings, shifts in sentiment can result in sharp corrections, citing the necessity for lively threat administration.

Rising developments — AI and memecoins

The present cycle is being formed not solely by particular person blockchain tasks but in addition by broader themes which can be influencing how capital, consideration, and improvement efforts are distributed throughout the crypto market.

Amongst these themes, synthetic intelligence and memecoins proceed to command disproportionate curiosity, although for fully completely different causes.

Tasks akin to Synthetic Superintelligence Alliance (FET) and Render (RENDR) are utilizing decentralized infrastructure to help AI-driven purposes, together with autonomous agent networks, provide chain analytics, and GPU useful resource sharing.

Each tasks may benefit from rising international demand for compute capability as centralized cloud suppliers encounter scaling limitations.

In parallel, memecoins stay one of many extra divisive areas of the crypto house. Regardless of frequent criticism over their speculative design and restricted utility, they proceed to draw substantial liquidity — particularly on high-speed blockchains akin to Solana.

Tokens like Bonk (BONK), Pepecoin (PEPE), and Brett (BRETT) have triggered sharp spikes in decentralized change exercise, fueled by group hype and viral narratives.

Dogecoin (DOGE), whereas nonetheless culturally related, has seen comparatively flat efficiency in latest months and has not matched the momentum of newer entries.

Memecoins are likely to behave extra like leveraged speculative devices than structured investments. Though they often generate fast worth surges, they continue to be extremely unstable and sometimes reply extra to influencer exercise and social media traction than to any basic driver.

Methods for investing in 2025’s crypto increase

Investing in crypto throughout a cycle marked by renewed momentum and increasing narratives requires greater than optimism. A structured method is crucial to navigate each alternative and threat.

Begin with allocation. Anchoring a portfolio with Bitcoin can present relative stability, notably as institutional inflows proceed to affect worth habits.

Whereas BTC could not supply the upside of rising tokens, its liquidity, market depth, and rising regulatory readability place it as a core holding in periods of uncertainty.

Including publicity to high-potential altcoins can complement that base, so long as place sizes account for heightened volatility. These belongings usually transfer sharply in each instructions and ought to be handled with warning.

Greenback-cost averaging stays one of many simpler entry methods, particularly in markets the place sentiment can shift with out warning.

Spreading entries throughout a number of weeks or months can scale back publicity to short-term worth swings and supply a extra measured path into the market.

Clear entry and exit methods assist scale back emotional decision-making. Having predefined targets makes it simpler to keep away from chasing rallies or holding belongings past their worth proposition.

Analysis stays one of the crucial underused benefits. Finding out whitepapers, monitoring GitHub contributions, and following group involvement can reveal whether or not a undertaking is constructing sustained momentum or just benefiting from hype cycles.

Threat administration ought to lengthen past asset choice. Utilizing chilly wallets for long-term storage, limiting reliance on centralized exchanges, and usually reassessing portfolio focus are crucial steps that defend capital.

The 12 months 2025 will not be solely about potential returns but in addition about execution. The tempo of change is quick. Tasks will surge and fade. Narratives will shift in a single day. Volumes will speed up and vanish simply as rapidly.

Staying targeted, sustaining self-discipline, and figuring out your limits will matter greater than ever. At all times make investments with a margin of security and by no means make investments greater than you may afford to lose.