Mantra has did not reap the benefits of immediately’s market rally, erasing earlier beneficial properties because of continued damaging sentiment.

Weeks after the collapse of the Mantra (OM) token, customers are nonetheless searching for solutions about what occurred. On Friday, Could 9, OM was down 2.09%, regardless of a broader market rally, buying and selling at $0.3667 and erasing its earlier beneficial properties.

Earlier within the day, the token had climbed to a each day excessive of $0.3923, suggesting the potential for a breakout. Nonetheless, it’s now trading below each its 10-day and 20-day easy transferring averages, which stand at $0.40614 and $0.4666, respectively.

If Mantra can reclaim and maintain these ranges, it could sign a attainable shift in momentum. For now, although, technical indicators and investor sentiment are weighing on the token, suggesting {that a} reversal is unlikely within the close to time period. As an alternative of a breakout, OM shortly retraced, persevering with the regular decline that has endured for weeks.

Traders nonetheless demand solutions over Mantra’s 95% drop

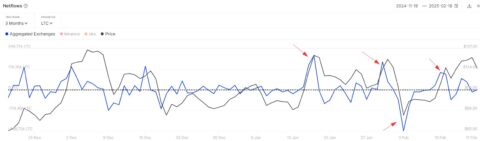

The token’s slide has continued for the reason that sharp collapse on April 13, when Mantra, a real-world asset token, all of the sudden misplaced 95% of its worth. Whereas the group initially blamed exchanges for liquidity mismanagement, on-line investigators have shared a unique narrative.

A number of on-chain sleuths, together with Choze and Onchain Lens, highlighted large movements from Mantra’s wallets to exchanges. Whereas not definitive proof of insider promoting, many locally imagine that’s precisely what occurred.

Fueling additional concern are allegations that the Mantra group controls as much as 90% of the token’s provide. In response to Onchain Lens, this stage of management allowed the group to artificially pump OM’s value for months.

In response to the crash and rising scrutiny, CEO John Mullin pledged to burn 150 million staked OM tokens, a portion of the group’s holdings. With a circulating provide of 1.66 billion, the burn would account for slightly below 10% of the token’s whole provide.