Two long-dormant Bitcoin wallets from the early “Satoshi period” have all of the sudden change into energetic after greater than a decade of silence, shifting a mixed $325 million value of Bitcoin simply forward of a serious U.S. Federal Reserve rate of interest resolution.

According to blockchain analytics platform Spot On Chain, the primary whale transferred 2,343 BTC, valued at roughly $222.2 million, to a brand new pockets after being inactive for 10.5 years. Historic information exhibits that this whale initially acquired round 2,187 BTC in July 2013 for simply $185,850, a mean value of $85 per coin.

The second whale re-emerged after greater than 11 years, shifting 1,079 BTC value roughly $102.5 million. This pockets’s Bitcoin holdings had been additionally accrued in mid-2013 for an estimated $91,713 at an identical per-coin value.

Whereas the precise motivations behind these transfers stay unclear, they might stem from recovered personal keys, modifications in possession, or long-term holders making ready to liquidate their positions after years of holding.

Notably, these vital actions come simply earlier than the Federal Reserve’s subsequent rate of interest announcement, scheduled for Wednesday, Might 7, 2025.

The Federal Reserve is broadly anticipated to take care of its present rate of interest vary of 4.25% to 4.50%, as policymakers take a cautious “wait-and-see” strategy amid ongoing financial uncertainties, together with the potential impacts of latest U.S. tariff insurance policies.

These giant whale transactions, timed so near the Fed’s announcement, counsel that these main gamers could also be positioning themselves forward of anticipated market volatility.

Bitcoin has been buying and selling in a slender vary, consolidating between $94,000 and $95,000 following a pullback from $97,700 on Might 2.

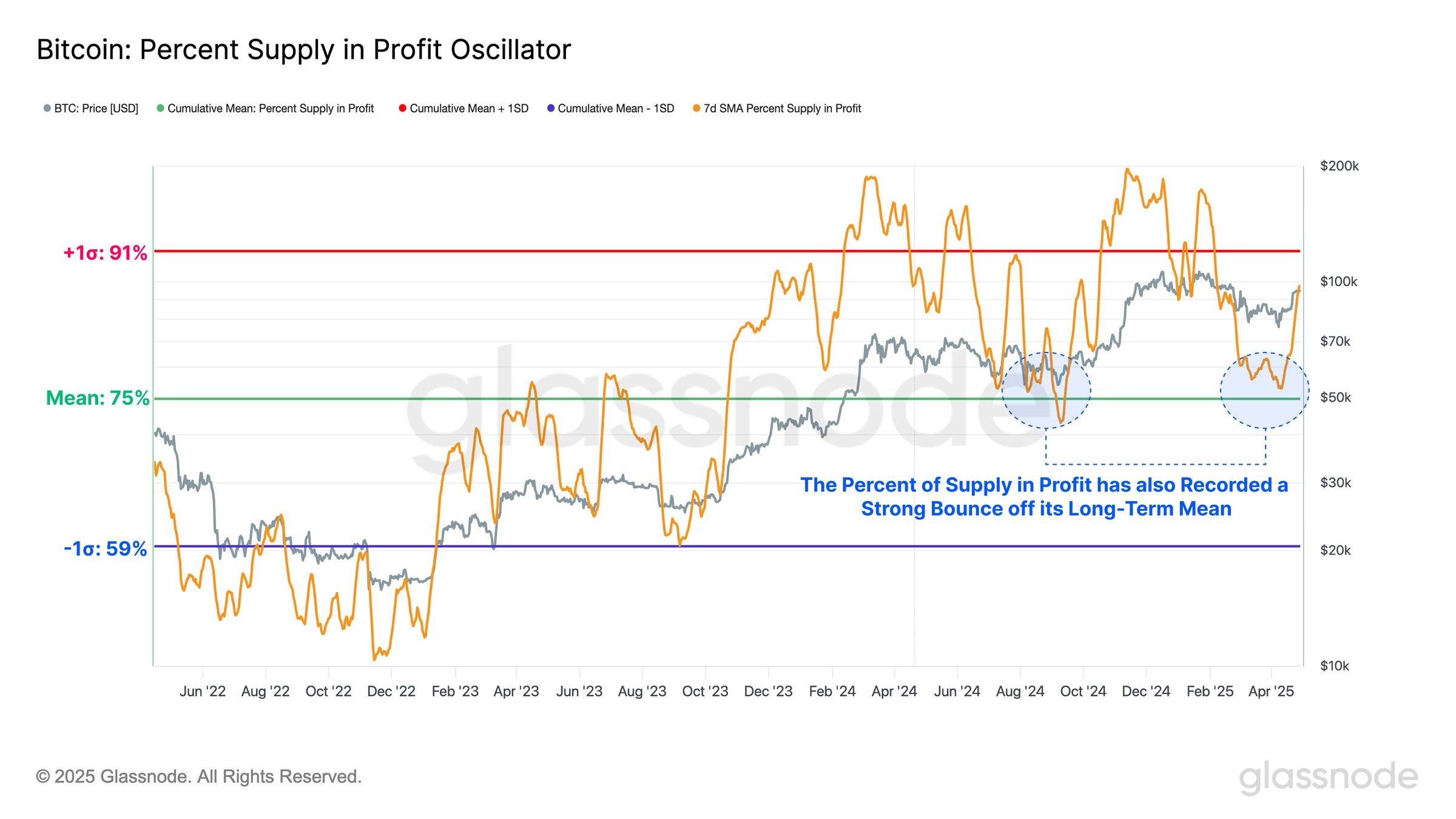

Additional, on-chain information displays a extremely worthwhile market atmosphere, elevating questions on whether or not some could also be making ready to lock in positive factors.

According to Glassnode, about 88% of Bitcoin’s circulating provide is at present in revenue, whereas many of the losses are sitting with individuals who purchased between $95,000 and $100,000.

In the meantime, Bitcoin’s MVRV Ratio has pulled again to its long-term imply of 1.74, a stage traditionally related to consolidation phases and investor reset intervals.

Moreover, the Realized Revenue/Loss (RPLR) ratio has rebounded above 1.0, suggesting a shift towards revenue realization amid enhancing sentiment.

This type of excessive profitability, following a rebound from a long-term imply of 75%, is often seen as a bullish signal, exhibiting that investor sentiment is enhancing and the market has reset its expectations.

Nonetheless, the Realized Revenue/Loss ratio now again above 1.0, alerts that extra holders would possibly begin locking in positive factors, which might add some short-term promoting stress on value.

At press time, Bitcoin (BTC) was exchanging arms at $94,175 per coin.

Disclosure: This text doesn’t signify funding recommendation. The content material and supplies featured on this web page are for academic functions solely.