After a pointy 75% rally, SUI is now exhibiting indicators of exhaustion because it approaches a key resistance space. Though the development stays bullish, technical indicators counsel a wholesome pause could also be on the horizon earlier than the following leg of enlargement.

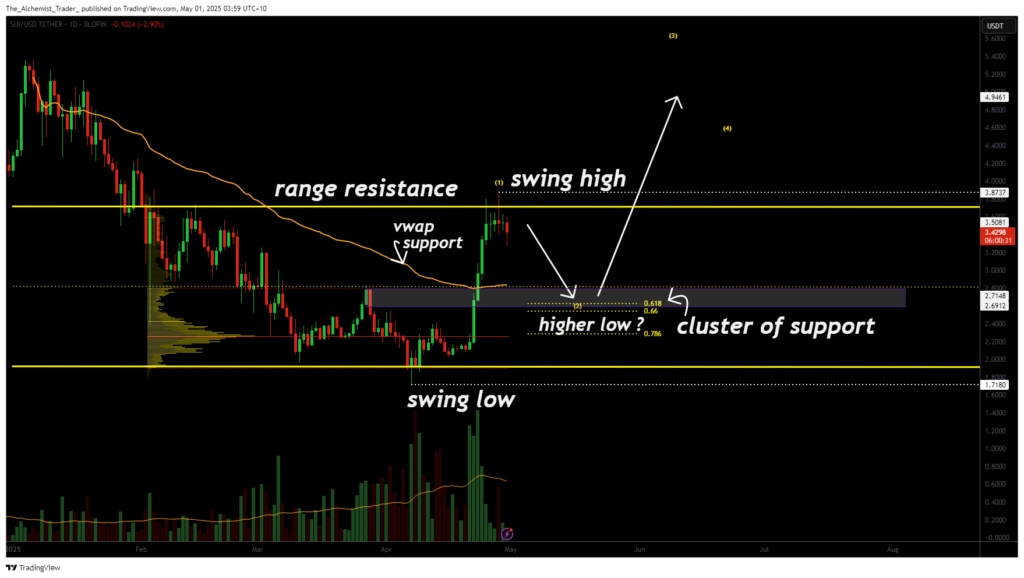

The impulsive nature of SUI’s (SUI) latest rally displays sturdy bullish momentum. Nevertheless, worth is now going through clear rejection from a resistance zone the place each the vary excessive and the 0.618 Fibonacci degree are stacked in confluence.

This zone isn’t arbitrary, it was beforehand established as a structural ceiling, and the present failure to interrupt cleanly by it kinds what seems to be a swing-failure sample (SFP). This provides weight to the concept a short-term pullback could unfold as half of a bigger development continuation.

Key technical factors,

- Main Resistance: Confluence of 0.618 Fibonacci retracement and vary excessive

- Assist Ranges to Watch: $2.70 to $2.40 (vary mid and VWAP help area)

- Development Construction: Potential wave 3 enlargement in play after corrective transfer

A possible short-term pullback could be technically wholesome, offering a possibility for the next low to type. Key zones to observe for this embrace the VWAP help area, the vary mid, and the 0.618 retracement degree, this time appearing as help on the way in which down. These areas function essentially the most possible launch factors for the following leg increased, probably initiating a wave 3 enlargement within the broader bullish construction.

It’s additionally vital to acknowledge that the market is coming into a section of steadiness, the place consumers and sellers are competing round key ranges. This sort of indecision typically precedes a volatility breakout, particularly following a robust impulsive transfer. Merchants ought to look ahead to quantity spikes and candle formations close to help for early clues.

Notably, whereas the latest rally was sturdy, quantity has began to taper, additional supporting the case for both consolidation or a correction. Worth is at the moment buying and selling inside an outlined vary between $2.70 and $2.40 and is prone to stay on this rotational zone till one among these ranges breaks convincingly with quantity.

What to anticipate within the coming worth motion

For now, merchants ought to stay affected person. The construction of the pullback, if it happens, will present essential clues as as to whether the following transfer is one other explosive rally or a deeper retracement. A break and maintain above the swing excessive would invalidate the pullback thesis, whereas a bounce from help would set the stage for additional upside.